Grey Power has for the past two years published results of a partial survey of members, which indicates that some aged pensioners ‘stay in bed’ during the day during winter as they have insufficient income to pay house heating costs.

This report attempts to quantify whether ‘staying in bed’ to keep warm during winter is due to insufficient income or poor budgeting.

Not all pensioners have to ‘stay in bed’ to keep warm in winter. Many superannuants have other sources of income such as savings or investment income to supplement New Zealand Superannuation (NZS). According to the latest Household Economic Survey (HES)1, about 14.9% of persons over 65 have additional income over and beyond New Zealand Superannuation.

The University of Otago2 estimate that 24% of New Zealanders are living in ‘fuel poverty’. ‘Fuel poverty’ is a relationship where the cost to heat their homes adequately, exceeds 10% of their income. This report will show the cost of home heating at the four major cities in New Zealand.

The Ministry of Social Development report ‘Household incomes in NZ’3, established two poverty levels of 50% and 60%. These poverty levels were based upon the ‘Before Housing Costs (BHC)’ income. As yet, unconfirmed reports indicate that between, 10% and 11% of persons aged over 65 have an income of less than 50% of the BHC income. Unquestionably, pensioners falling under the 50% poverty line are financially impoverished and this applies to between 44,700 and 49,200 aged pensioners.

Pensioners who do not own their own home are likely to fall below these poverty levels. The briefing paper of 20054 prepared for the incoming Minister of Social Development states that in the 65 to 85 age group, 12% to 13% of aged pensioners live in rented accommodation.

Is the reason that some superannuitants can afford heating, due to additional income derived from past savings or is it as a result of lower costs of housing as a result of home ownership?

This report investigates the adequacy of New Zealand Superannuation to provide a ‘standard of living consistent with human dignity and approaching that enjoyed by the majority’5 for aged pensioners who rent and have no other source of income.

Summary

This report finds that aged pensioners who do not own their own home and who do not have other sources of income are severely financially disadvantaged and it is probable that some pensioners may ‘stay in bed to keep warm because of costs’.

Some aged pensioners (without other income) have insufficient funds to adequately heat their homes and qualify as being in ‘fuel poverty’2.

To remedy this parlous financial situation for that group of NZS pensioners, Government should increase the Accommodation Supplement by about $65.0016 per week.

The Royal Commission of Social Security (1972)5 recommended, in part, that “The community is responsible for giving dependent people a standard of living consistent with human dignity and approaching that enjoyed by the majority, irrespective of the cause of dependency.”

This report contends that Royal Commission recommendations are not being achieved.

A question was included in the 2007 Household Economic Survey (HES)1 seeking responses from participants as to whether they stayed in bed because of costs. To obtain the results of this survey Statistics NZ require payment of over $400. If the survey finds that aged pensioners stay in bed to keep warm because of costs, then it is beyond doubt that pensioners without other income sources are financially disadvantaged.

Income

In October 2008, the amount of NZ Superannuation for an eligible couple was $462.74 per week. There was no expectation of any increase in NZS until the normal annual review in April 2009.

Expenses

From the NZS payment, aged pensioners must pay for the necessities of life and there should be sufficient remaining to achieve ‘standard of living consistent with human dignity’.

In this report the assumption is made that aged pensioners will pay certain expenses which they believe are essential. The balance remaining has to provide the necessities of life.

To determine which expenses are essential, the assistance of the Budget Advisory Service6, was sought. The Budget Advisory Service6 said that most persons seeking their help pay the following expenses:

a) Rent

b) Electrical energy

c) Telephone

d) Health Services

Rental

Rental

For a pensioner who doesn’t own their own home, the cost of accommodation rental is their largest expenditure. The NZ government has recognised the significant cost of accommodation rental for persons receiving a benefit by providing an accommodation supplement7.

Electrical Energy

Electrical Energy

The cost of heating2 the whole of a modern home with full insulation (to code) from 7am to 11pm to 180 C is dependant upon the geographic location of the home, see below.

The reality is that most rental properties are not modern homes with full insulation. Rental homes are likely to be older and have higher energy costs to adequately heat. According to the University of Otago9, the typical costs to heat a Housing New Zealand Corporation rental home are shown below.

The above tables are show just the house heating costs and exclude other household energy consumption. The following table includes these other energy costs.

The above tables are show just the house heating costs and exclude other household energy consumption. The following table includes these other energy costs.

As a comparison, the ‘low energy’ usage rate for electrical energy in Tauranga is $1,351 per annum10 , noting that this amount of energy is insufficient to adequately heat most public sector homes.

In the warmest city, Auckland if a superannuitant couple were to heat their house adequately, then average weekly energy cost could exceed 10% of their gross income and place that couple into ‘fuel poverty’9.

In the warmest city, Auckland if a superannuitant couple were to heat their house adequately, then average weekly energy cost could exceed 10% of their gross income and place that couple into ‘fuel poverty’9.

Based on the assumption that a superannuitant would inadequately heat their home by using half of the energy nominated by the University of Otago and the couple lived in Auckland / Tauranga region, the electrical energy charges are as follows.

Based on the assumption that a superannuitant would inadequately heat their home by using half of the energy nominated by the University of Otago and the couple lived in Auckland / Tauranga region, the electrical energy charges are as follows.

The New Zealand Herald reported (28 August 2008) that the average monthly power bill was $165 charged by Mercury Energy was to rise in the Auckland region. The increases ranged from 2.5% to 5.7% effective from October 1st. Meridian Energy and Contact Energy had previously announced increases of 6% – an increase of around $10 per month for the average household.

Telephone Expenses

Telephone Expenses

The Cost of providing the lowest cost option to provide a telephone service including line rental and free local calls provided by Telecom or Telstra-Clear.

Health Services

The cost to aged pensioners (65 years +) of Health Services was $20.60 per week according to the Household Economic Survey of 2004 published by Statistics New Zealand. No comparable figures were published in the same survey in 2007.

In this report we have not indexed the weekly average expense of $20.60 to compensate for CPI changes, and hence the amount for Heath Costs is probably understated.

Pension after Base Expenses Deducted

Pension after Base Expenses Deducted

Based upon the experience of Budget Advisory Services, the base expenses would be paid by an aged pensioner couple before other living expenses. It will be noted that no provision has been made for medication expenses.

Food Costs

We have chosen to use the cost of food and non-food items derived from the University of Otago, Food Cost quarterly survey11. The nearest Uni of Otago surveyed city to Tauranga is Hamilton and costs for Hamilton were been utilised, see the following.

The University of Otago13 surveys the weekly costs of food on a ‘balanced diet’ according to the NZ Food and Nutrition guidelines. Of the three purchase cost categories , we have used the lowest cost named ‘Basic’. The Basic cost category assumes that all foods will be prepared at home. It includes the most commonly consumed fruits and vegetables and the lowest priced items within each food category.

The University of Otago13 surveys the weekly costs of food on a ‘balanced diet’ according to the NZ Food and Nutrition guidelines. Of the three purchase cost categories , we have used the lowest cost named ‘Basic’. The Basic cost category assumes that all foods will be prepared at home. It includes the most commonly consumed fruits and vegetables and the lowest priced items within each food category.

After deducting those base costs that aged pensioner couple place the highest priority and food costs, there is $126.58 per week remaining.

It is more difficult to predict how the remaining pension is allocated. The method chosen in this study is based upon the latest Household Economic Survey of 200714, where the average weekly household expenditures were surveyed.

We have taken those costs from the HES 2007 survey14 and removed any expenditure that can be eliminated (such as food, holiday expenses, dwelling insurance, vehicle insurance). Based upon these average NZ household expenses, we have tabulated those expenses, see below.

We have taken those costs from the HES 2007 survey14 and removed any expenditure that can be eliminated (such as food, holiday expenses, dwelling insurance, vehicle insurance). Based upon these average NZ household expenses, we have tabulated those expenses, see below.

Before deducting the typical expenses surveyed in the Household Economic Survey14 an aged pensioner couple had $126.58 of discretional funds. Based upon the typical expenses gathered by HES 2007 survey, average household expenses of $282.20 per week could be expected.

Aged pensioners only have $126.58 to allocate and are faced with expenses typically of $282.20. The shortfall between what is required to ‘a standard of living consistent with human dignity and approaching that enjoyed by the majority’5, and the available amount is $155.62 per week, or $8,092.24 per annum.

Conclusion

The conclusion that the author draws from this report is that for aged pensioners who have no other income and who do not own their own home are at a significantly financial and sociological disadvantage.

These pensioners are not guilty of bad budgeting decisions as the reason why they may choose ‘stay in bed’ during winter to keep warm. Their financial situation is such that they cannot achieve ‘a standard of living consistent with human dignity and approaching that enjoyed by the majority.4

To overcome these severe financial hardships, the author recommends that an increase be made to the Accommodation Supplement for aged pensioners to increase the payment to approximately $62.00 per week.

The increase suggested above in the Accommodation Supplement is based upon achieving equality in disposable income with other aged pensioners who own their own homes and don’t have any additional income. Refer to the following page/s for the method used to calculate the increase in the Accommodation Supplement.

References & End Notes

1. Statistics NZ,, Household Economic Survey, November 2007, Table 6.

2. University of Otago,

http://wwww.physics.otago.ac.nz/eman/hew/ehome/energyperfco2.html

3. Ministry of Social Development, Household incomes in NZ: trends in indicators of inequality and hardship 1982 to 2007.

4. Briefing paper of 2005 prepared for the incoming Minister of Social Development.

5. The 1972 Royal Commission on Social Security

The report of the (1972) Royal Commission of Social Security is one of the landmarks in New Zealand social history. In a wise and detailed manner it codified the existing social security system, providing a foundation for subsequent social policy discussion. The Royal Commission was charged only with reviewing the social security system, but its vision was somewhat wider. Two and more decades after, the informed are till likely back to refer to it. So should the reader. Here are its `essential principles on which we consider our social welfare system and its administration should be based.’

“(1) The community is responsible for giving dependent people a standard of living consistent with human dignity and approaching that enjoyed by the majority, irrespective of the cause of dependency. We believe, further, that the community responsibility should be discharged in a way which does not stifle personal initiative, nor unduly hinder anyone trying to preserve or even enhance living standards on retirement or during times of temporary disability.

(2)The aims of the system, should be

… (i) First, to enable everyone to sustain life and health;

… (ii) Second, to ensure, within limitations which may be imposed by physical or other disabilities, that everyone is able to enjoy a standard of living much like that of the rest of the community, and thus is able to feel a sense of participation in and belonging to the community;

… (iii) Third, where income maintenance alone is insufficient (for example, for a physically disabled person), to improve by other means, and as far as possible, the quality of life available.

(3) Social security cash benefits are only one aspect of the total problem of maintaining incomes and raising living standards. Taxation, wages, employment, economic development, education, health, housing, social services, and cultural policies are all also of great importance. There is a manifest need therefore to co-ordinate those areas which impinge on, one another.

(4) Need, and the degree of need, should be the primary test and criterion of the help to be given by the community irrespective of what contributions arc made.

(5) Coverage should be comprehensive irrespective of cause wherever need exists, or may be assumed to exist.

(6) Identification and measurement of need is essential if the primary test is to be observed. We believe that this is best done by establishing categories of people who are most likely to bc unable to derive adequate incomes from the market system, or who are most likely to face unusual expense in maintaining an acceptable standard of living. It is still necessary either to:

… (i) Discriminate between those falling within a category (for example, the aged, the widowed, the sick) who need or do not need help, or to find out how much help is needed (the selective approach); or to

… (ii) Assume that need exists, and therefore dispense with further discrimination where the expectation of need within a category is high enough, and other considerations (such as the effect of taxation) are favourable. (This is the universal approach.)”

6. Budget Advisory Service, Tauranga Branch

7. Benefits Rights Service, Wellington, Accommodation Supplement Sheet, dated April 2008

8. Market Rent, Department of Building and Housing, web site, July 2008

9. University of Otago,

http://wwww.physics.otago.ac.nz/eman/hew/econtacts/articlefuelpoverty.html

10. Consumer.org.nz; Powerswitch table

11. Telecom.co.nz; Homeline basic plan, July 2008

12. TelstraClear.co.nz; Phoneline basic plan, July 2008

13. University of Otago, Food Cost Survey, Human Nutrition

14. Statistics NZ,, Household Economic Survey, November 2007, Table 1

15. Department of Internal Affairs; Rates Rebate Scheme brochure, revised threshold as of 1 July 2006

16. Accommodation Supplement — Additional Funding Calculation

The purpose of the following calculations is to determine how much additionally should be paid, via the Accommodation Supplement, to bring aged pensioners that have no additional income and rent their living accommodation; to the same disposable income as similar aged pensions that own their own home.

Assume the average council rates in Tauranga are $2,000 p.a. Obviously, council rates vary from house to house and from one region to another. The current Accommodation Supplement has provision for different regions so regional differences can be normalised.

Rating differences within a town for the most part do not greatly affect these calculations. For example, a difference of say 15% from the arbitrary rate chosen for Tauranga results in a difference of only $5.77 per week, or put another way about 1.3% of the current NZS pension payment.

{11}Based upon local council rates of $2,000 and aged pensioner couple can expect to pay $38.46 per week. For aged pensioners with no additional income, the Government provides a ‘Rates Rebate12’ that reduces the yearly rates payment, as illustrated below.

There are other additional costs that house owning Superannuitants pay that do not apply to those pensioners that rent. These costs include house insurance and maintenance.

The author has extracted those costs shown in the latest Household Economic Survey of 200714 as shown below.

The author has extracted those costs shown in the latest Household Economic Survey of 200714 as shown below.

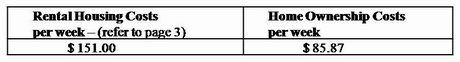

The net cost for council rates (from the preceding page) was $25.57 per week. Additionally, the costs of house maintenance and dwelling insurance are $60.30, a total weekly cost of $ 85.87.

Comparing the costs of aged pensioners who rent against those who own their own home, it can be readily determined that those who rent are severely financially disadvantaged.

Comparing the costs of aged pensioners who rent against those who own their own home, it can be readily determined that those who rent are severely financially disadvantaged.

The difference between superannuitants who rent verses those that own their own home is $65.13 per week. To achieve equity and reduce the severe financial disadvantages for non-home owners, the Accommodation Supplement should be increased by about $65 per week.

Article courtesy and copyright of John Logan 2008, 17 October 2008

- 9 years ago

I regularly stay in bed till noon in the winter in Dunedin to save on power.

Another thing to do is sit in a chair with a duvet over you and a hot water bottle while watching TV. Sometimes in the evening I have the luxury of the heater on very low and with good insulation etc this is adequate.

My power bill as a result can be around $100 for the worst of the winter months. Cheers.