I often think about the money tips I wish someone had given me twenty five years ago. While there are plenty of good examples of these, I reckon I can boil most of it down to three key pieces of advice, which I will do my best to drum into my own children.

I often think about the money tips I wish someone had given me twenty five years ago. While there are plenty of good examples of these, I reckon I can boil most of it down to three key pieces of advice, which I will do my best to drum into my own children.

Firstly, spend less than you earn.

That sounds fairly simple, and it is, but plenty of people (and even a few governments around the world) still manage to get it wrong.

Whether you’re a company, a country or an individual, it’s difficult to get into too much trouble if you spend less than what you’re bringing in.

If you need to rely on your overdraft or credit card balance each month, revisit your outgoings and ruthlessly cut some expenses you can live without.

Secondly, never borrow money to buy depreciating assets.

Debt can work in your favour, but only when you use it for things that tend to rise in value over a reasonable period of time. Using borrowed money to invest in a house, a business or an investment (which includes your education) is the sensible use of debt.

Borrowing to buy a new phone, pair of shoes, TV, or car is not a smart use of debt as you end up paying the original price and interest on top, while the value of what you’ve purchased is in constant decline from the moment you swipe your credit card, which is a terrible combination for your personal balance sheet.

In just about every case, if you have to borrow money for it, then you simply can’t afford it.

Thirdly, start saving or investing as early as you can.

When it comes to investing, there are few things more powerful than time.

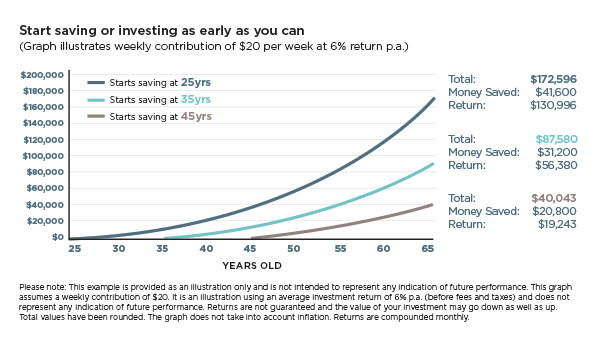

Consider someone who began saving $20 a week at age 45 and managed to earn a 6% return per annum (ignoring inflation, for simplicity).

They would have $40,000 when they’re 65 years old and of that, $19,000 would be purely due to returns on their investment; additional to the money they saved each week.

If they had started a decade earlier at 35, the grand total jumps to $87,000 with an investment return component of $56,000. As we bring the start date forward even further, the results increase exponentially, such is the power of compounding returns.

Starting at age 25, the $20 a week is worth a whopping $172,000, with an investment return component of $131,000.

When you’re young, the future benefits of such discipline seem so far away that it’s not even close to being a priority.

However, for those that can grasp the concept and commit to some sort of regular savings plan, there are genuine benefits down the track.

Not everyone has the luxury of being able to follow this sort of advice.

There are all kinds of reasons why people end up in unfortunate financial situations. Things can spiral out of control quickly, and sometimes no amount of being frugal can dig people out of some indebted situations.

However, we hope that at least having the conversation with your grandchildren, will help drive financial literacy higher, arming young people with a few basic (but important) concepts to make their financial journey a little smoother.

By Mark Lister – Head of Private Wealth, Craigs Investment Partners.

Like what you’ve read? Click here to subscribe to our fortnightly eNewsletter

Related Articles & Resources

Five Steps to Start Investing video>

The foundation of a resilient investment portfolio>

3 financial rules to each your kids video>

Please fill out the form below if you have any questions or would like more details on any of the above:

Craigs Investment Partners Limited is an NZX Participant Firm. Mark Lister is Head of Private Wealth Research Craigs Investment Partners; Adviser Disclosure Statements and Product Disclosure Statements are available on request and free of charge. Please visit Craigsip.com for more information. This information is general information only and Craigs Investment Partners Limited has not taken into account the investment objectives, financial situation or particular needs of any particular person. Investments are subject to risk and are not guaranteed. Before making any investment decisions, Craigs Investment Partners recommends you contact your investment adviser. Neither Craigs Investment Partners do not accept liability for the results of any actions taken or not taken upon the basis of this information.

Join the Discussion

Type out your comment here:

You must be logged in to post a comment.