Read more Oily Rag articles by Frank and Muriel Newman

A new study out last week reminds us how important it is to develop the savings habit early. From what people are telling us, we know that about one in ten people living off the smell of an oily rag do so primarily to increase their savings. They don't need to cut costs – they live off the smell of an oily rag so that they can save more. They know saving today is the path to a more secure financial future tomorrow – and for some, the keys to their first home.

The "Attitudes to Money" survey published by AMP Financial Services has some interesting numbers. It showed that those who save as children are much more likely to save as adults and become mortgage free.

One of the key messages in the report was that if parents want to teach their kids good money habits they need to do more than simply giving them pocket money – they need to teach them how to save it. Here are some of oily rag tips:

- Let kids "bank" their savings. In other words, if they can think of ways to save money around the home, let them keep say half or a quarter of the savings.

- Don't call their allowance "pocket money" call it a "wage" for the good deeds they do in helping out around the house and contributing to a happy oily-rag home life. Jobs like doing the dishes, vacuum cleaning, dusting, watering the plants, washing the car, mowing lawns, setting the table, cooking a favourite dish, and so on.

- Encourage kids to save towards a certain goal. Write the goal and the amount on a label and stick it onto a jar. Then see how fast they can fill the jar!

- Play money games at home. The Monopoly board game been frequently credited for inspiring property tycoons.

- Start a Kiwisaver account for kids and show them how savings in Kiwisaver can grow through the miracle of compound interest (and the government's kick-start!).

- When gift giving, think about giving an investment – a term bank deposit, a Kiwisaver account, shares in one of the big name companies, or a calf or other livestock that can be farmed and bred, if you have spare land.

- When shopping, give them the responsible job of checking prices and making sure you have bought the best value by comparing different packet sizes. Not only will it be a valuable shopping lesson, but their maths will improve! (TIP: a calculator may be required for tricky calculations like the cost per gram when comparing different packet sizes.)

- There are heaps of money-making opportunities for children. Money-spinning jobs include collecting aluminium cans, jobs around the home, making Christmas and birthday cards for friends and relatives, delivering papers or pamphlets, and of course lawn mowing. All you need is two or three lawn mowing jobs and there you have it – $s. Target those who can afford it and are too busy, such as a couple where the wife and husband are both working.

Learning the savings habit early will bring a life-time of rewards. We think there are a few other virtues that pocket money can teach kids besides thrift – hard work and personal responsibility are others that come to mind.

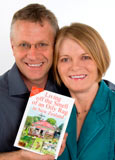

* Frank and Muriel Newman are the authors of Living off the Smell of an Oily Rag in NZ. Readers can submit their oily rag tips on-line at www.oilyrag.co.nz. The book is available from bookstores and online at www.oilyrag.co.nz.

Join the Discussion

Type out your comment here:

You must be logged in to post a comment.